Financial budget planner software tv#

Personal and family: Cellphone bills, entertainment-including TV streaming services like Netflix and other subscriptions like Spotify-fitness, pet expenses, household supplies, personal care (haircuts, toiletries, etc.), and clothing.Also include any student loan payments you have. for children in K-12 and adults going to college. Education: Tuition, supplies, fees, etc.

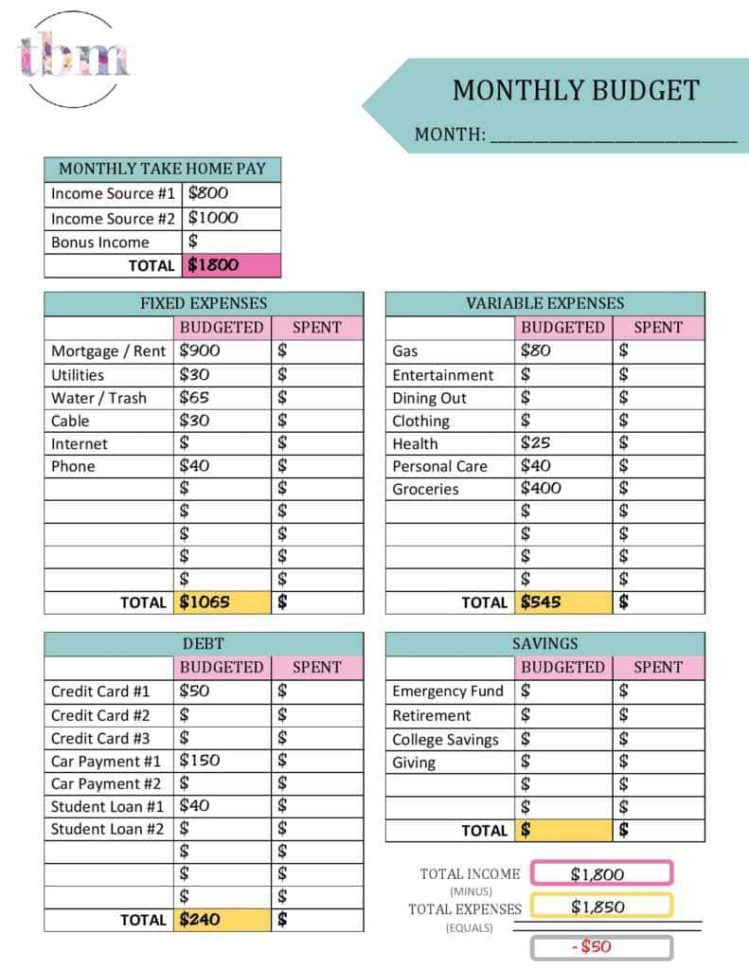

Transportation: Public transportation like buses, but also car-related expenses, including your monthly loan payment, repairs, insurance, tolls, and fuel.Food: What you spend on food from the grocery store, eating out at restaurants, getting takeout, or meal delivery services.You can also account for other necessary housing-related expenses, like utility bills, homeowners or renters insurance, and maintenance bills. Housing: Your rent or mortgage payment.Income: Your total take-home income, including any money you earn from side hustles, alimony, child support, part-time jobs, etc.We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The content provided on Moneywise is information to help users become financially literate. Information and timely news from our team of trusted money specialists. In this guide, we'll highlight the seven that we think are the best and share how they can help you manage your money.

Financial budget planner software software#

Here at Investor Junkie, we've tested and reviewed dozens of personal finance software options. No matter what kind of service you need, there's an app for that! Whether you're looking for personal accounting software or a bill pay app, the software options listed here should have you covered. But which one should you pick? Here is our best personal finance software list. Whether it’s generating reports, updating plans, or reviewing client assetsmake quick adjustments, speed up data entry, and increase accuracy with eMoney’s financial planning software. There are hundreds of personal accounting apps that can make money management a breeze. Save time and money with one centralized product. Whether you need to create (and stick to) a budget, monitor your credit score, or even pay your bills on time, personal finance software can help. Please be aware that some (or all) products and services linked in this article are from our sponsors. We adhere to strict standards of editorial integrity to help you make decisions with confidence.

0 kommentar(er)

0 kommentar(er)